How we started

We did a deep dive into how customers gain financial advice from the internet, what podcasts they listen to, what youtube videos they watched, and how they searched for financial advisors. We found there wasn’t a straight forward path into how users can find this information. It was really up to them to put the pieces together.

We also researched how financial advisors promote themselves to the public. We found most only advertised through google search, LinkedIn, and a few small advertisements on social media. These were not reaching the clientele they wanted.

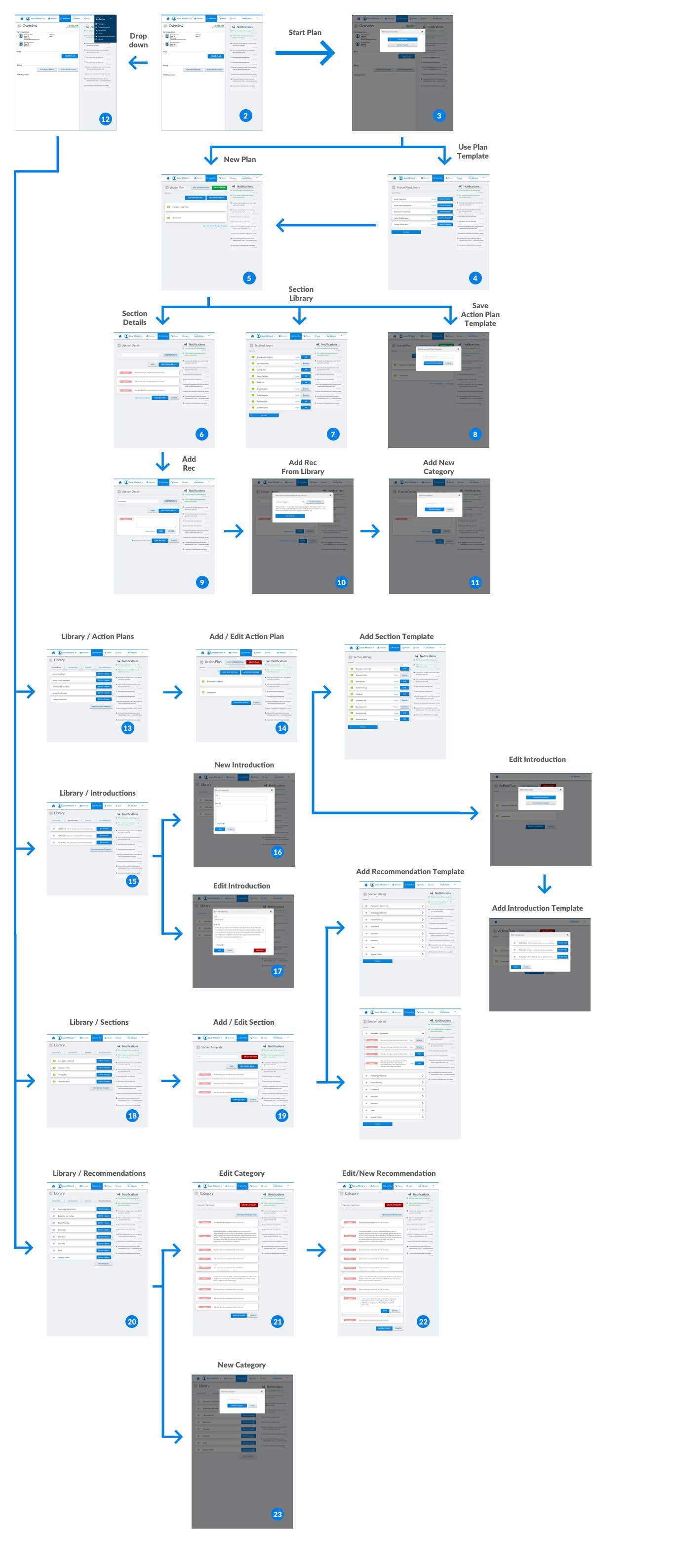

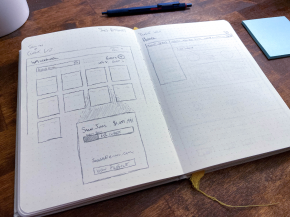

Working through the user flow

We did a deep dive into how customers gain financial advice from the internet, what podcasts they listen to, what youtube videos they watched, and how they searched for financial advisors. We found there wasn’t a straight forward path into how users can find this information. It was really up to them to put the pieces together.

We also researched how financial advisors promote themselves to the public. We found most only advertised through google search, LinkedIn, and a few small advertisements on social media. These were not reaching the clientele they wanted.

Website design

Wealthminder's financial planning and practice management software enabled clients to enter data about their goals, existing assets, future savings and willingness to accept risk. It then helped financial advisors create a financial plan and set of recommendations / advice for their client. Clients had online access to their plan and both parties could monitor process against the plan.

Wealthminder also provided a directory of information about financial advisors on its site to enable consumers to research and compare financial advisors. In addition, it allowed consumers to request proposals from the fee-only fiduciary advisors that participate in its network.