How we started

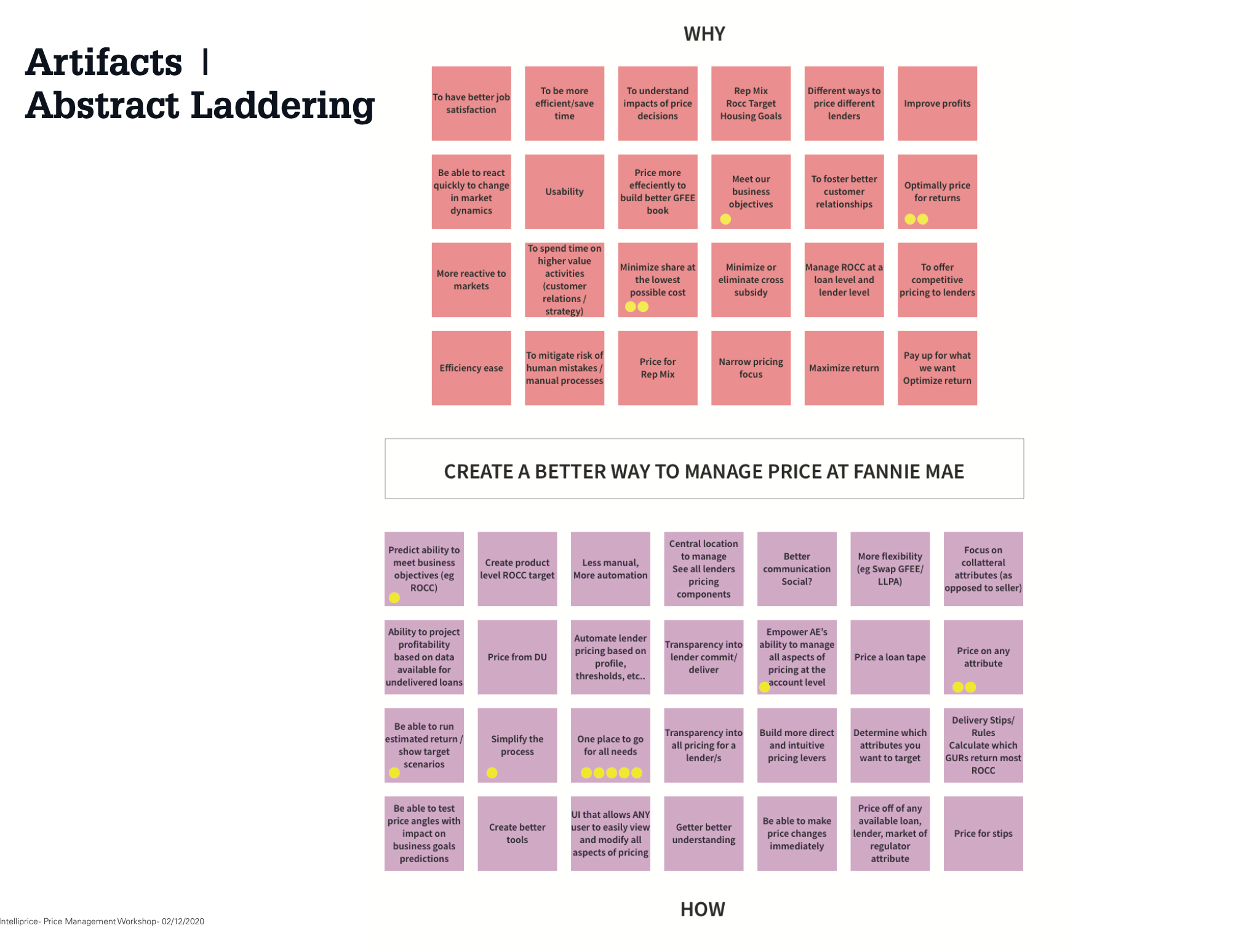

We shadowed traders during their workday to see what their processes were. We observed them taking in loan offers, analyze the loans, and break down the best price for the batch. Through our discussions with traders, they would rather trade individual loans which would guarantee the best return. But the current system wouldn't allow for it. So we needed to come up with a system that would give the traders all of the information they needed and be able to bid on individual loans.

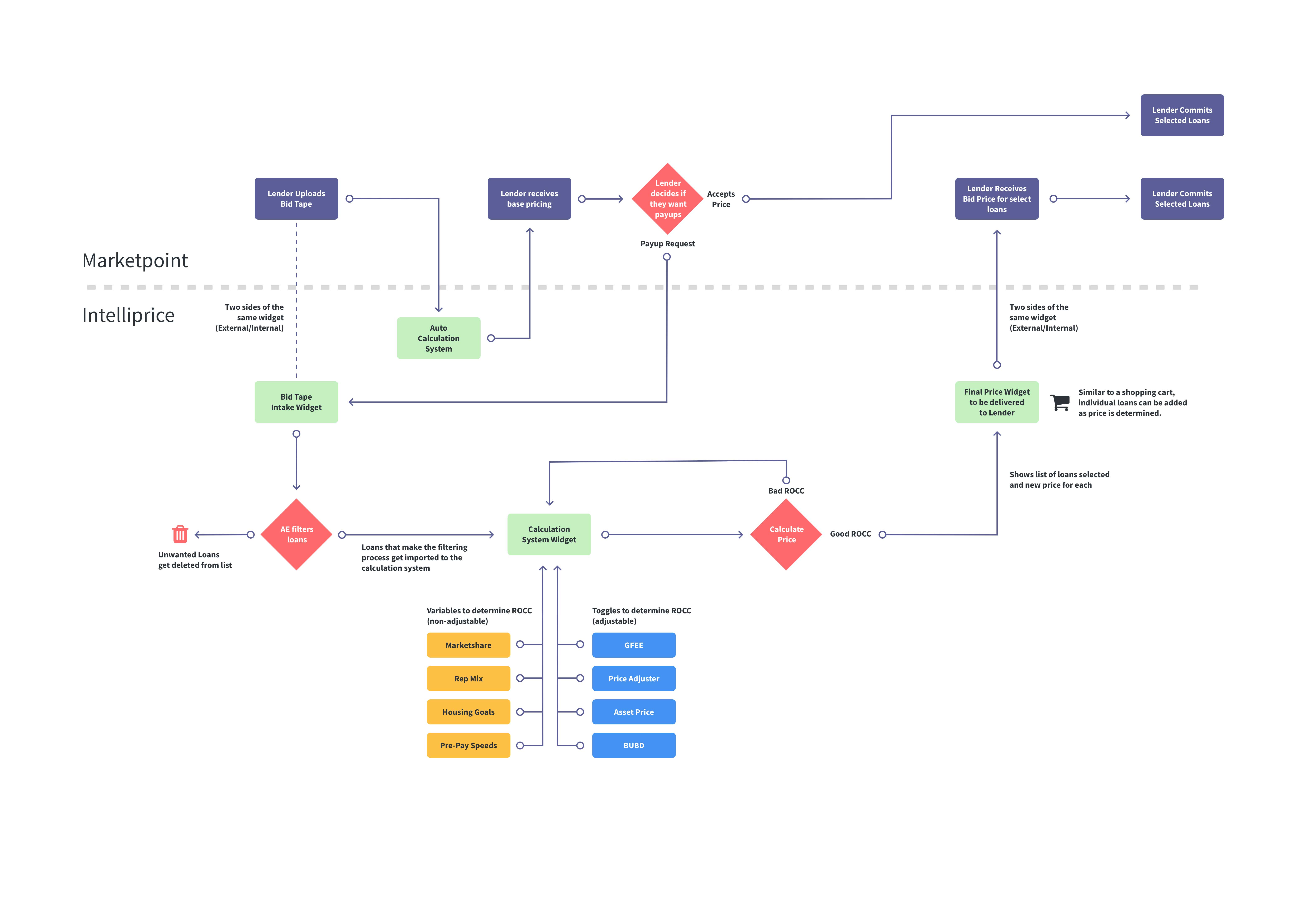

Determine user flow

Determined how traders currently traded loans, we walked them through several user flows on how the new engine could intake lenders bid sheets, analyze each loan, and based on custom pricing pre-set in the system, can give the best price for returns on corporate capital (ROCC).

We also determined several personas that would need to conduct different tasks based on their roles. Analysts would study the market and determine pricing for loan types. Traders could price loans off of those set prices. Managers would oversee the trades and make changes to pricing based on market movement.

To save more time, traders were given the ability to set rules to apply to several different types of trades automatically. The time consuming part of the trader's job was eliminated giving the traders more time to focus on increasing their ROCC in other areas.

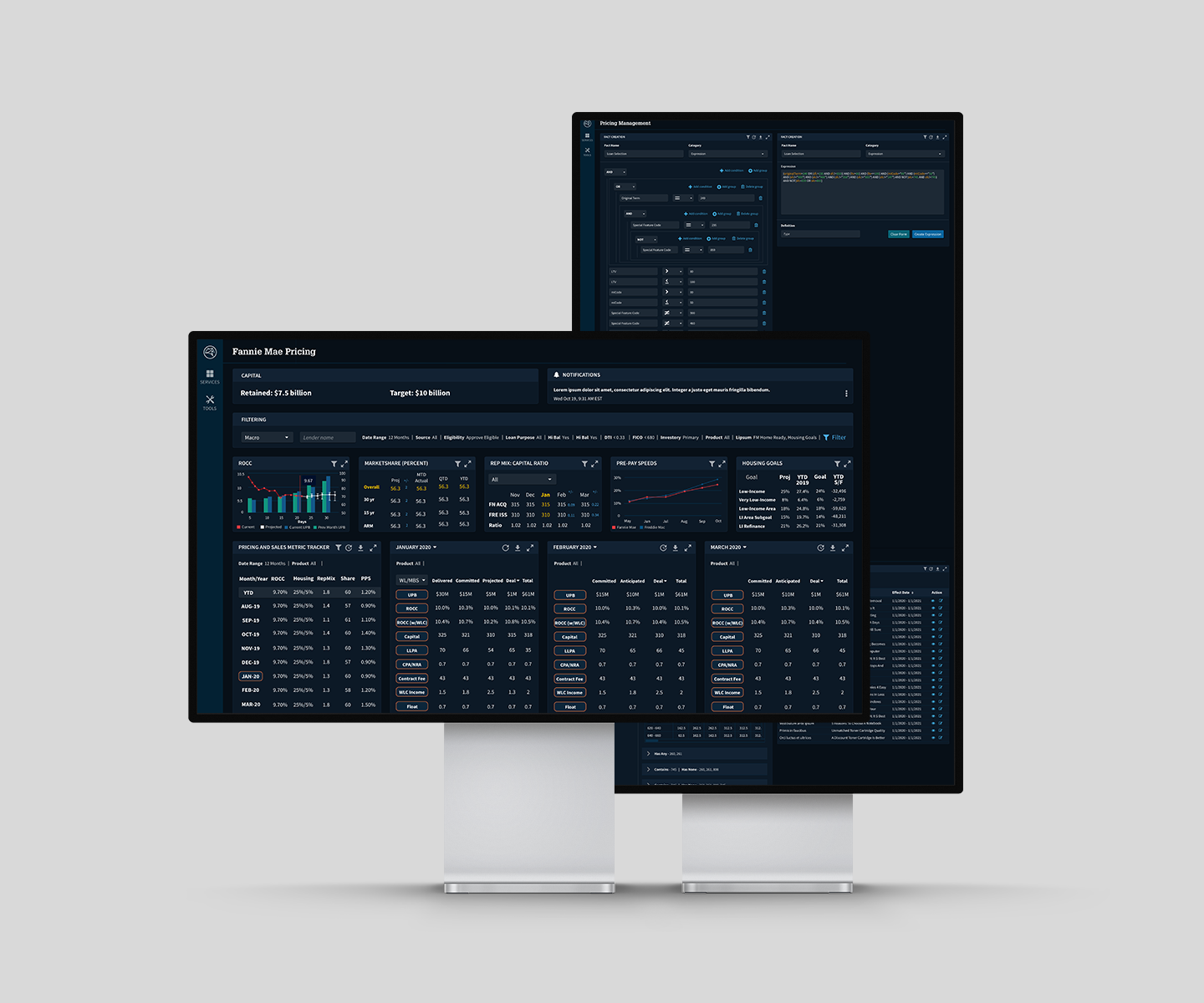

Dashboard design

We designed a dashboard that would be customizable to each user based on needs and tasks. Some personas would require pricing statistics to set current pricing trends, while other personas, like traders, would want to see incoming lender's bid sheets to see what loans were available to bid on.

A manager's persona would have a bird's eye view of the entire trading desk and what was occurring between all personas.

By setting up personas at the beginning, we could create detailed custom dashboards for each, with additional customization by the user, similar to the Bloomberg terminal.